The introduction of Commercial Paper in India was considered the beginning of financial reforms in India. Post liberalization the Indian government introduced many short-term instruments to tackle the various financial needs and situations of financial crisis one of which was Commercial papers. Let us take a look.

Suggested Videos

Commercial Paper Definition

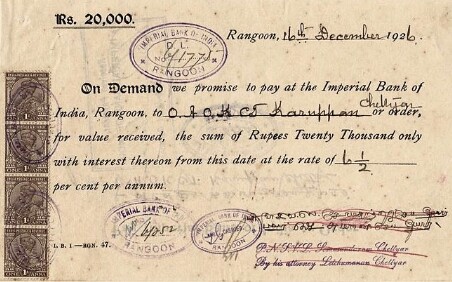

Commercial paper is a money-market security issued (sold) in the commercial paper market by large corporations to obtain funds to meet short-term debt obligations (for example, payroll) and is backed only by an issuing bank or company promise to pay the face amount on the maturity date specified on the note.

Commercial Paper

Imagine this scenario to get an idea of what a commercial paper is; You had lunch in a restaurant and the bill is ₹900, you give ₹2000 note but the cashier does not have a chance to give back. He gives you a paper and writes on it, “We are to give Mr. You ₹1100 in cash or either You can have a meal worth ₹1100 from one of our branches within the one-month duration.” He signs it and issues a stamp of the restaurant on it. Should you accept it? Definitely.

This was just an example to give you an idea of what commercial papers are. Commercial papers are usually issued at a high value. It is unsecured money market instrument issued in the form of a promissory note and transferable between Primary Dealers (PDs) and the All-India Financial Institutions (FIs).

Browse more Topics under Sources Of Business Finance

- Classification of Sources of Funds

- Commercial Banks and Financial Institutions

- Debentures

- Equity Shares and Preference Shares

- Lease Finance and Public Deposits

- International Financing and Choice of Source of Funds

- Meaning, Nature and Significance of Business Finance

- Retained Earning, Trade Credit and Factoring

Individuals, banking companies, other corporate bodies (registered or incorporated in India) and unincorporated bodies, Non-Resident Indians (NRIs) and Foreign Institutional Investors (FIIs) etc. can invest in Commercial Papers. However, investment by FIIs would be within the limits set for them by Securities and Exchange Board of India (SEBI) from time-to-time.

Commercial Papers emerged as a source of short-term finance in India in the early nineties. As we discussed, Primary Dealers (PDs) and the All-India Financial Institutions (FIs) issue commercial papers which is an unsecured promissory note to raise funds for a short period of 90 days to 364 days.

The money raised by the commercial paper is generally very large. It is generally issued by one firm to another business firms, insurance companies, pension funds and banks. Its regulation comes under the purview of the Reserve Bank of India (RBI). As the RBI does not want to risk the funds, only the firms having good credit rating can issue the commercial paper.

source: kt5

Merits of Commercial Paper

- Technically, it provides more funds compared to other sources. The cost of commercial paper to the issuing firm is lower than the cost of commercial bank loans.

- It is in freely transferable nature, therefore it has high liquidity also a wide range of maturity provide more flexibility.

- A commercial paper is highly secure and does not contain any restrictive condition.

- Companies can save their extra funds on commercial paper and also earn some good return on the same.

- Commercial papers produce a continuing source of funds. This is because their maturity can be tailored to suit the needs of issuing firm. Again, commercial paper that matures can be repaid by selling the new one.

Limitations of Commercial Paper

- Only financially secure and highly rated organizations can raise money through commercial papers. New and moderately rated organizations are not in a position to raise funds by this method.

- The amount of money that we can raise through commercial paper is limited to the deductible liquidity available with the suppliers of funds at a particular time.

- Commercial paper is an odd method of financing. As such if a firm is not in a position to redeem its paper due to financial difficulties, extending the duration of commercial paper is not possible.

Solved Question for You

Question: The maturity period of commercial papers usually ranges from

(a) 20 to 40 days

(b) 60 to 90 days

(c) 120 to 365 days

(d) 90 to 364 days

Answer: (d)90 to 364 days.

visit businessandinvesting.com